Watch new videos on international cooperation here

Corporate Banking's international branches are the local guide our clients need. Not only are the branches tuned in to the needs and expectations of clients from our core markets, they know their way around the local banking and insurance world and are experts in meeting regional requirements. This international cooperation generates success by combining short decision lines, SPOCs, high levels of expertise and in-house dealing rooms.

Local guide leads to success

1 300 clients

The branches

136 FTE in 3 branches

Asia Pacific

529 clients

47 FTE

New York

75 clients

8 FTE

Milan

Milan is the youngest international branch, with a portfolio including clients such as Cegeka, Cevolani, Orsa Foam, Agrifood Abruzzo and Pepco Italy. This branch thus serves a wide range of clients from diverse sectors and industries such as IT, mechanical engineering, chemicals, food, clothing, etc. located throughout Italy. Covalpa is currently implementing an investment programme to build a new processing and freezing plant in order to increase production and storage capacity and make it more efficient, so as to meet Agrifood Abruzzo's procurement needs. The investments are financed by a combination of grants from the Italian government and long-term loans from Italian public and private bodies supporting the agricultural sector. However, this financing package requires a bridging loan for up to 18 months, as the grants and long-term loans will only be made available during the construction period.

1750 clients

60 FTE

Lille/Paris

KBC France follows a strategy of focusing on Belgian and Central European Midcap clients operating in France (inbound) and French groups operating in our home markets (outbound). KBC France also has a specialist Acquisition financing team, also focusing on midcaps. In addition, KBC France has a subsidiary, KBC Bail Immobilier France, which engages in real estate lease finance activities for a number of our core Belgian clients such as Katoennatie, Vandemoortele, Clarebout, etc. The construction of the new Clarebout plant is one of the key projects in the port of Dunkirk.

Other familiar names include: Deloitte, Ziegler, Ardo, Pathé and UCG cinemas and a number of traders such as Louis Dreyfus and Sucres et Denrées.

700 clients

23 FTE

Düsseldorf

The German branch is located in Düsseldorf and serves both Belgian and German corporate clients throughout Germany. Anotable recent case concerned the participation by GBL (Groupe Bruxelles Lambert) in financing the acquisition of Canyon Bicycles.

29 FTE

Rotterdam

This branch has a diverse Dutch client portfolio: listed companies, as well as private (family) businesses from different sectors. Close collaboration with the network in Flanders offers advantages and regularly leads to successful outcomes.

500 clients from the UK and EU

52 FTE

London

Since Brexit, this branch has seen an increase in the number of Belgian companies setting up legal entities in the UK, and vice versa. This has been a source of many new clients. Brexit created a clear need for guarantee facilities to support the payment of customs and import duties to the UK government. There is close collaboration with Flanders Investment & Trade to identify and support UK companies looking to expand into Belgium.

Notable recent transactions include green loans for Albea Creative (3.2 million GBP) and Kronospan (4 million GBP).

The aim of the three branches in Asia is to provide convenient services to our clients in the Asia home market. Each branch has a different DNA, embedded in the local setting:

Shanghai is primarily focused on financing manufacturing companies in China.

Singapore facilitates international trade for our clients, in line with Singapore's position as a trade hub situated at the crossroads of many trade routes between Europe and Asia

Hong Kong offers home market clients support in both their trade and investment plans, mainly related to mainland China. This is consistent with Hong Kong's position as a gateway to China.

KBC New York assists companies headquartered in one of KBC's core markets with their US banking needs. It also supports US companies that have local subsidiaries and bank with KBC Group in Belgium and throughout Central and Eastern Europe.

KBC New York has the network, resources and expertise to deliver value-added solutions to its clients looking to capitalise on opportunities in the US. 'We go with you' is not merely a hollow marketing phrase at KBC New York.

KBC New York offers clients domestic cash management solutions (KBC New York is affiliated to all major US payment systems), trade and other financing solutions and liquidity management solutions. KBC New York works closely with our colleagues in the home market and the PFN deal is a clear example of the '1 bank, 1 team' strategy being put into practice.

Asia

Europe

USA

1

11

3

- One working language: English

- Effective internal communication

- Sharing ideas and best practices

- Regular updates

- Everyone has the same information

For international projects, colleagues from different countries, and sometimes on different continents, form one team.

As one man to the customer: how do you do it?

Cross-border projects are part of everyday business for these colleagues.

3

PF Nonwovens

2

DEUFOL

The German packaging and logistics specialist Deufol was looking to finance the acquisition of what would become the group's Hungarian arm. German and Hungarian colleagues brought this financing project worth 16 045 million EUR to a successful conclusion.

1

OBTON

The Danish company OBTON has invested in a portfolio of solar farms at eight sites in Hungary. This international cooperation across five countries attracted funding of 72.2 million EUR in September 2021 courtesy of the Corporate Banking teams at K&H and CSOB.

The Czech company PF Nonwovens found a partner in CSOB to expand in the US. The project team, consisting of Czech and US colleagues, cashed in on the strong relationship with the client and secured financing for the largest Czech acquisition in the US, to the tune of 260 million USD.

3

pearls of international cooperation

60 per cent of Belgium‘s top 1 000 KBC Corporate Banking and Senior Bankers clients use at least one foreign entity.

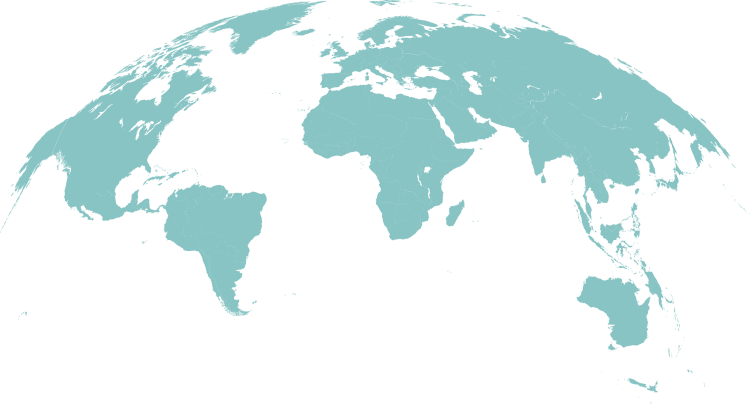

Corporate Banking has a presence in 14 countries outside Belgium, thanks to a strong market position in KBC's five home countries and nine international branches.

International cooperation

The cornerstone of KBC Commercial Banking

1 300 clients

Watch new videos on international cooperation here

Corporate Banking's international branches are the local guide our clients need. Not only are the branches tuned in to the needs and expectations of clients from our core markets, they know their way around the local banking and insurance world and are experts in meeting regional requirements. This international cooperation generates success by combining short decision lines, SPOCs, high levels of expertise and in-house dealing rooms.

Local guide leads to success

London

The aim of the three branches in Asia is to provide convenient services to our clients in the Asia home market. Each branch has a different DNA, embedded in the local setting:

Shanghai is primarily focused on financing manufacturing companies in China.

Singapore facilitates international trade for our clients, in line with Singapore's position as a trade hub situated at the crossroads of many trade routes between Europe and Asia

Hong Kong offers home market clients support in both their trade and investment plans, mainly related to mainland China. This is consistent with Hong Kong's position as a gateway to China.

136 FTE in 3 branches

Asia Pacific

KBC New York assists companies headquartered in one of KBC's core markets with their US banking needs. It also supports US companies that have local subsidiaries and bank with KBC Group in Belgium and throughout Central and Eastern Europe.

KBC New York has the network, resources and expertise to deliver value-added solutions to its clients looking to capitalise on opportunities in the US. 'We go with you' is not merely a hollow marketing phrase at KBC New York.

KBC New York offers clients domestic cash management solutions (KBC New York is affiliated to all major US payment systems), trade and other financing solutions and liquidity management solutions. KBC New York works closely with our colleagues in the home market and the PFN deal is a clear example of the '1 bank, 1 team' strategy being put into practice.

529 clients

47 FTE

New York

Milan is the youngest international branch, with a portfolio including clients such as Cegeka, Cevolani, Orsa Foam, Agrifood Abruzzo and Pepco Italy. This branch thus serves a wide range of clients from diverse sectors and industries such as IT, mechanical engineering, chemicals, food, clothing, etc. located throughout Italy. Covalpa is currently implementing an investment programme to build a new processing and freezing plant in order to increase production and storage capacity and make it more efficient, so as to meet Agrifood Abruzzo's procurement needs. The investments are financed by a combination of grants from the Italian government and long-term loans from Italian public and private bodies supporting the agricultural sector. However, this financing package requires a bridging loan for up to 18 months, as the grants and long-term loans will only be made available during the construction period.

75 clients

8 FTE

Milan

KBC France follows a strategy of focusing on Belgian and Central European Midcap clients operating in France (inbound) and French groups operating in our home markets (outbound). KBC France also has a specialist Acquisition financing team, also focusing on midcaps. In addition, KBC France has a subsidiary, KBC Bail Immobilier France, which engages in real estate lease finance activities for a number of our core Belgian clients such as Katoennatie, Vandemoortele, Clarebout, etc. The construction of the new Clarebout plant is one of the key projects in the port of Dunkirk.

Other familiar names include: Deloitte, Ziegler, Ardo, Pathé and UCG cinemas and a number of traders such as Louis Dreyfus and Sucres et Denrées.

1750 clients

60 FTE

Lille/Paris

The German branch is located in Düsseldorf and serves both Belgian and German corporate clients throughout Germany. Anotable recent case concerned the participation by GBL (Groupe Bruxelles Lambert) in financing the acquisition of Canyon Bicycles.

700 clients

23 FTE

Düsseldorf

This branch has a diverse Dutch client portfolio: listed companies, as well as private (family) businesses from different sectors. Close collaboration with the network in Flanders offers advantages and regularly leads to successful outcomes.

29 FTE

Rotterdam

Since Brexit, this branch has seen an increase in the number of Belgian companies setting up legal entities in the UK, and vice versa. This has been a source of many new clients. Brexit created a clear need for guarantee facilities to support the payment of customs and import duties to the UK government. There is close collaboration with Flanders Investment & Trade to identify and support UK companies looking to expand into Belgium.

Notable recent transactions include green loans for Albea Creative (3.2 million GBP) and Kronospan (4 million GBP).

500 clients from the UK and EU

52 FTE

The branches

Asia

Europe

USA

1

11

3

The Czech company PF Nonwovens found a partner in CSOB to expand in the US. The project team, consisting of Czech and US colleagues, cashed in on the strong relationship with the client and secured financing for the largest Czech acquisition in the US, to the tune of 260 million USD.

3

PF Nonwovens

The German packaging and logistics specialist Deufol was looking to finance the acquisition of what would become the group's Hungarian arm. German and Hungarian colleagues brought this financing project worth 16 045 million EUR to a successful conclusion.

DEUFOL

2

The Danish company OBTON has invested in a portfolio of solar farms at eight sites in Hungary. This international cooperation across five countries attracted funding of 72.2 million EUR in September 2021 courtesy of the Corporate Banking teams at K&H and CSOB.

1

OBTON

3

pearls of international cooperation

- One working language: English

- Effective internal communication

- Sharing ideas and best practices

- Regular updates

- Everyone has the same information

For international projects, colleagues from different countries, and sometimes on different continents, form one team.

Cross-border projects are part of everyday business for these colleagues.

As one man to the customer: how do you do it?

60 per cent of Belgium's top 1 000 Corporate Banking clients use at least one foreign entity.

Corporate Banking has a presence in 14 countries, thanks to a strong market position in KBC's five home countries and nine international branches.

International

cooperation

The cornerstone of KBC Commercial Banking